Super Micro Computer, Inc.( SMCI) is a crucial player in the tech assiduity, furnishing high- performance computing results and advanced garçon technologies. For investors and tech suckers, the company’s stock price can be an important index of its performance and growth eventuality. In this composition, we’ll take a comprehensive look at smci stock price, covering its recent trends, what influences its movements, and factors to consider for unborn price oscillations.

Overview of Super Micro Computer, Inc. (SMCI)

Super Micro Computer, Inc. is a global leader in high- performance computing, specializing in energy-effective and high- performance garçon technologies. The company provides a broad range of garçon results, including data center structure, pall computing platforms, storehouse systems, and high- performance enterprise waiters. Their products feed to colorful sectors, similar as artificial intelligence( AI), machine literacy, the Internet of effects( IoT), and edge computing.

Innovated in 1993, SMCI has endured substantial growth, riding on the reverse of its innovative results that have helped reshape data center and computing technologies. This growth has not only been reflected in their product portfolio but also in their stock performance.

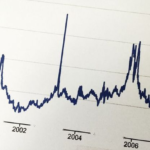

Recent Stock Performance

In recent times, smci stock price has seen substantial oscillations, largely driven by the company’s earnings reports, inventions in the tech assiduity, and broader profitable conditions. As ofmid-2024, SMCI stock has shown strong upward instigation due to favorable earnings reports, request expansions, and increased demand for advanced garçon technology.

Here are some key factors that have influenced SMCI’s stock price in recent months:

- Earnings Reports: Like numerous tech stocks, SMCI’s stock price tends to change following daily earnings reports. Positive earnings, strong profit growth, and beating critic prospects have led to upward stock price movements. Again, if the company misses prospects, indeed slightly, the stock can witness sharp declines.

- Growth in AI and Cloud Computing: The ongoing global demand for artificial intelligence and pall- grounded results has been a significant motorist for SMCI. Companies looking to gauge their AI operations and move their services to the pall bear more important and effective waiters. Super Micro Computer is at the van of this trend, furnishing the necessary structure, which boosts investor confidence and stock price.

- Supply Chain Challenges: The ongoing global demand for artificial intelligence and pall- grounded results has been a significant motorist for SMCI. Companies looking to gauge their AI operations and move their services to the pall bear more important and effective waiters. Super Micro Computer is at the van of this trend, furnishing the necessary structure, which boosts investor confidence and stock price..

- Expansion into New Markets: The company’s harmonious sweats to expand into new geographic requests and arising diligence have increased its profit base. For case, expanding into high- growth areas like edge computing and 5G technology has allowed SMCI to stay ahead of its challengers, fueling positive investor sentiment.

Key Metrics to Watch

For those interested in tracking smci stock price and understanding its movements, then are a many crucial criteria that can give sapience

- Earnings per Share (EPS): This crucial metric measures the company’s profitability on a per- share base. Advanced EPS indicates stronger profitability and generally leads to a rise in stock price. Investors should keep an eye on SMCI’s daily earnings reports to gauge unborn stock movements.

- Price-to-Earnings (P/E) Ratio: The P/ E rate is a popular valuation standard that compares a company’s stock price to its earnings per share. A advanced- than-average P/ E rate could suggest that smci stock price is overrated, while a lower- than-average P/ E rate may indicate undervaluation. Comparing SMCI’s P/ E rate to its peers can offer sapience into whether the stock is priced fairly.

- Revenue Growth: Super Micro Computer’s capability to grow its profit is critical to maintaining investor confidence. profit growth, particularly in high- demand sectors like AI and pall computing, can be a strong index of unborn stock price appreciation.

- Market Sentiment: Overall investor sentiment and broader request trends can have a significant impact on smci stock price. External factors, similar as changes in the tech assiduity, interest rate hikes, affectation, and geopolitical pressures, can all impact how investors perceive the company’s stock.

Why Investors Are Paying Attention to SMCI Stock

There are several reasons why investors are nearly covering smci stock price, especially in the current tech- driven request terrain.

1. Rapid Growth in Key Industries

SMCI operates in high- growth sectors similar as AI, pall computing, and edge computing. These diligence are anticipated to continue their growth line, meaning companies like Super Micro Computer are well- deposited to profit from the adding demand for advanced computing structure.

2. Innovation and Expansion

Super Micro Computer is n’t just riding the surge of current assiduity trends but is laboriously driving invention. The company’s commitment to energy-effective garçon technologies, scalability, and high- performance results makes it an seductive option for businesses looking to optimize their data centers and calculating power. This commitment to invention has also caught the eye of investors who see long- term value in the company’s capability to stay ahead of challengers.

3. Global Demand for IT Infrastructure

The demand for IT structure has noway been lesser, thanks to advancements in pall computing, 5G, and the adding reliance on data centers. SMCI is a crucial player in this space, furnishing the backbone for numerous critical technologies. As demand for similar structure continues to rise, so too does the eventuality for SMCI’s stock price to appreciate.

4. Strong Financial Performance

SMCI’s strong financials, driven by steady profit growth, healthy profit perimeters, and harmonious earnings beats, have garnered positive attention from both institutional and retail investors. The company’s capability to maintain this fiscal performance while expanding its request share adds to the bullish sentiment around its stock.

Risks to Consider

While SMCI has multitudinous growth openings, it is n’t without pitfalls. Investors should consider the following

- Competition: The tech assiduity is largely competitive, with major players like Dell, IBM, and Hewlett Packard Enterprise also offering advanced garçon technologies. violent competition could limit SMCI’s request share growth.

- Supply Chain Disruptions: Ongoing Force chain issues, particularly the global semiconductor deficit, could affect SMCI’s capability to meet demand and negatively impact profit and stock price.

- Market Volatility: The tech assiduity is known for its volatility, and smci stock price is no exception. request corrections or downturns can affect in significant oscillations in stock price.

Conclusion

smci stock price has proven to be a strong pantomime in the tech assiduity, serving from the rapid-fire growth in demand for advanced computing results. Investors who are interested in tech stocks with significant growth eventuality may want to keep a close eye on Super Micro Computer. still, like any investment, it’s essential to consider the pitfalls and stay informed about request trends and company developments.